Office:888-440-2531

Sales:512-453-2533

Tech:512-406-1640

Financing

If you need help with financing your LED display, give us a call today at 888-440-2531 or call me directly at 512-844-2794. We’d be happy to help and we can make the entire process FAST, EASY, and AFFORDABLE.

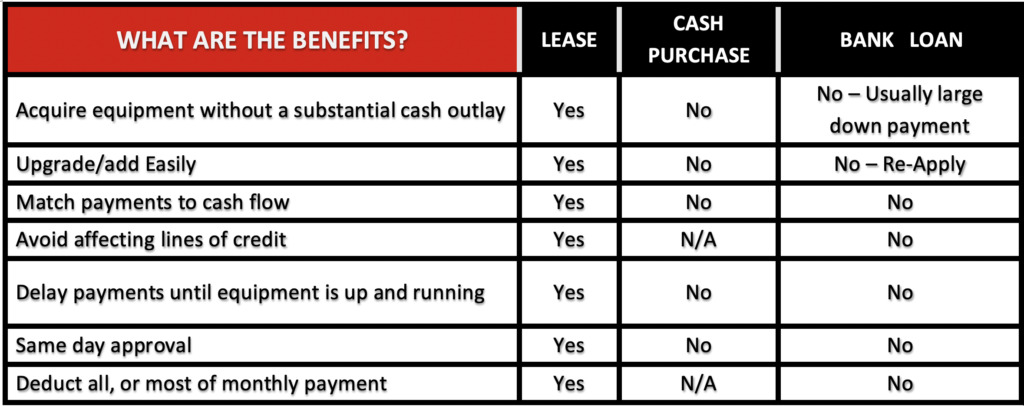

With the wide array of financial solutions that we have available, we are confident that we can provide you with the capital needed to purchase or lease your LED sign display.

5 Year Lease Estimates

Amount Financed Estimated Monthly Payment ***

$10,000 $199/month

$15,000 $305/month

$20,000 $410/month

$25,000 $510/month

$30,000 $610/month

$35,000 $710/month

$40,000 $810/month

***Please Note***

Monthly payments are estimates. Your actual payments may be lower or higher than those shown depending upon current interest rates and the details of your application. Based upon a 5 year lease period, good credit history and a $1 buyout option.

179 Tax Write-off Advantages

What is the Section 179 Deduction?

Most people think the Section 179 deduction is some mysterious or complicated tax code. It really isn’t, as you will see below.

Essentially, Section 179 of the IRS tax code allows businesses to deduct the full purchase price of qualifying equipment and/or software purchased or financed during the tax year. That means that if you buy (or lease) a piece of qualifying equipment, you can deduct the FULL PURCHASE PRICE from your gross income. It’s an incentive created by the U.S. government to encourage businesses to buy equipment and invest in themselves.

Several years ago, Section 179 was often referred to as the “SUV Tax Loophole” or the “Hummer Deduction” because many businesses have used this tax code to write-off the purchase of qualifying vehicles at the time (like SUV’s and Hummers). But, that particular benefit of Section 179 has been severely reduced in recent years, see ‘Vehicles & Section 179’ for current limits on business vehicles.

Today, Section 179 is one of the few incentives included in any of the recent Stimulus Bills that actually helps small businesses. Although large businesses also benefit from Section 179 or Bonus Depreciation, the original target of this legislation was much-needed tax relief for small businesses – and millions of small businesses are actually taking action and getting real benefits.

Essentially, Section 179 works like this:

When your business buys certain items of equipment, it typically gets to write them off a little at a time through depreciation. In other words, if your company spends $50,000 on a machine, it gets to write off (say) $10,000 a year for five years (these numbers are only meant to give you an example).

Now, while it’s true that this is better than no write off at all, most business owners would really prefer to write off the entire equipment purchase price for the year they buy it.

In fact, if a business could write off the entire amount, they might add more equipment this year instead of waiting over the next few years. That’s the whole purpose behind Section 179 – to motivate the American economy (and your business) to move in a positive direction. For most small businesses (adding total equipment, software, and vehicles totaling less than $500,000 in 2013), the entire cost can be written-off on the 2013 tax return.

Limits of Section 179

Section 179 does come with limits – there are caps to the total amount written off ($1,040,000 in 2020), and limits to the total amount of the equipment purchased ($2,590,000 in 2020). The deduction begins to phase out dollar-for-dollar after $2,000,000 is spent by a given business, so this makes it a true small and medium-sized business deduction.

After the passage of the ‘American Taxpayer Relief Act’, large businesses that exceed the threshold of $2,000,000 in capital expenditure can take a Bonus Depreciation of 50% on the amount that exceeds the above limit. Nice.

For Additional Section 179 info please refer to IRS publication below:

Click here to visit our LED Outdoor Signs.